how does the arizona charitable tax credit work

HOW DOES THE ARIZONA CHARITABLE TAX CREDIT WORK. HCC was chosen for the forth year in a row to be a part of IMPACT AZ where every tax credit gift helps us win additional grant funding.

Thiel Backed Masters To Face Kelly After Arizona S Record Setting Gop Senate Primary Opensecrets

Maintain a receipt of your gift from the charity in order to provide a copy with your tax.

. Joint taxpayers can donate up to 800 to QCOs and 1000 to QFCOs. Prepare your state income tax return Starting in 2013 you do not have to itemize your deductions. This individual income tax credit is available for contributions to Qualifying Charitable Organizations that provide immediate basic needs to residents of Arizona who receive temporary assistance for needy families TANF benefits are low income residents of Arizona or are individuals who have a chronic illness or physical disability.

Every Arizona taxpayer who donates. Our QCO code is 20544. Step 1 - Donate to Military Assistance Mission Step 2 - File taxes claim Arizona Charitable Tax Credit Step 3 - Receive your tax credit celebrate supporting Arizona military families.

Beginning in 2016 the amount of this credit is 800 for married taxpayers filing jointly. Keep reading in order to learn more about what the Arizona Charitable Tax Credit is who it helps and the restrictions surrounding it. Make your donation to Sojourner Center.

How does it work. For a single taxpayers or heads of household the maximum credit is 400. Provide food to hungry military families and children in need Assist with rentmortgage utilities car payments and insurance.

How Does the Arizona Charitable Tax Credit Work. The state credits totaling 5035 for married filing joint and 2519 for. Donation to Paz de Cristo.

Vincent de Paul 829 S. The Limitations to the Tax Credit As referenced by Give Local Keep Local single taxpayers those who are married and filing separately and heads of households can donate up to 400 to QCOs and 500 to QFCOs. Individuals making cash donations made to these charities may claim these tax credits.

Complete Arizona Tax Form 321 and include it with your state return. Arizona State Taxes Now Owed. There are four steps to document your donation and claim your tax credits.

A donation to Paz de Cristo may qualify you for the Arizona Charitable Tax Credit which can lower Arizona state taxes up to 400 for individuals and up to 800 for couples filing jointly. With a 3 tax rate you would owe 1173 in taxes. When you donate you will help.

For each dollar donated you get either a credit to reduce your tax liability or a reimbursement to increase your tax refund. You can donate online using our one time donation form. Donate to a certified charitable organization QCO or QFCO such as a 501 c 3 organization like Phoenix Childrens Hospital.

Contributions to Qualifying Charitable Organizations Contributions to Qualifying Foster Care Charitable Organizations Investment in Qualified Small Business Credit. The Arizona Charitable Tax Credit formerly known as the Working Poor Tax Credit is a tax credit for anyone who has made voluntary cash contributions during any taxable year to a Qualifying Charitable Organization. The Arizona Charitable Tax Credit gives you the unique opportunity to direct your tax dollars to local qualifying charities and organizations that matter to you.

There are four 4 steps to document your donation and claim your tax credits. Our QCO code is 20255. There are four steps to document your donation and claim your tax credits.

The Arizona Charitable Tax Credit is completely. Neighborhood Outreach Access to Health NOAH is an official Qualifying Charitable Organization. Donate to a certified charitable organization QCO or QFCO such as a 501 c 3 organization like Marys Food Bank.

6th Avenue Tucson AZ 85701. These credits give you the opportunity to direct your tax dollars to the schools and charities of your choice at no cost. How Does it Work.

Fortunately the process for making a charitable contribution and claiming the Arizona Charitable Tax Credit is relatively straightforward. Arizona State Taxes Owed. If you have any questions please call us at 480-818-5285.

Make a donation now to the Society of St. Please consider donating today. Your gift will offer women and children a welcoming community a safe place to live and learn and on-going services to help them become self-sufficient.

Donate to a certified charitable organization QCO or QFCO such as a 501c3. Arizona State Taxes Now Owed. Arizona law provides an income tax credit for cash contributions made to certain charities that provide help to the working poor.

The state of Arizona issues each qualified charity partner a Qualifying Charitable Organization Code. We will mail you a donation receipt for your records. AZ Tax Credit QQCO Code.

Fortunately the process for making a charitable contribution and claiming the Arizona Charitable Tax Credit is relatively straightforward. Individuals making cash donations made to these charities may claim these tax credits on their Arizona Personal Income Tax returns. An Edward Jones Financial Advisor Can Partner Through Lifes Moments.

Every Arizona taxpayer who donates to Sojourner Center qualifies for the Arizona Charitable Tax Credit. Or mail your check to The Singletons 2501 W Behrend Dr Suite 1. New Look At Your Financial Strategy.

List Sojourner Center as your charitable organization along with your donation amount on AZ Form 321. List JFCS as your charitable organization along with your donation amount on AZ Form 321. Only money can be gifted to receive the tax credit.

Visit The Official Edward Jones Site. So technically it doesnt cost you a penny. See your tax professional for advice.

20157 You will use this code on your return. A married couple filing jointly can get a tax credit for up to 800 off their Arizona State tax liability by leveraging a donation to Maggies. You do not need to itemize deductions to claim the tax credit.

Complete the relevant tax form to claim one or more. How Does it Work.

Tax Credit Central Arizona Shelter Services

Tax Credit Phoenix Country Day School

Outdoor Patio Furniture Stores Outdoor Furniture Stores Patio Store Outdoor Patio Furniture

List Of 6 Arizona Tax Credits Christian Family Care

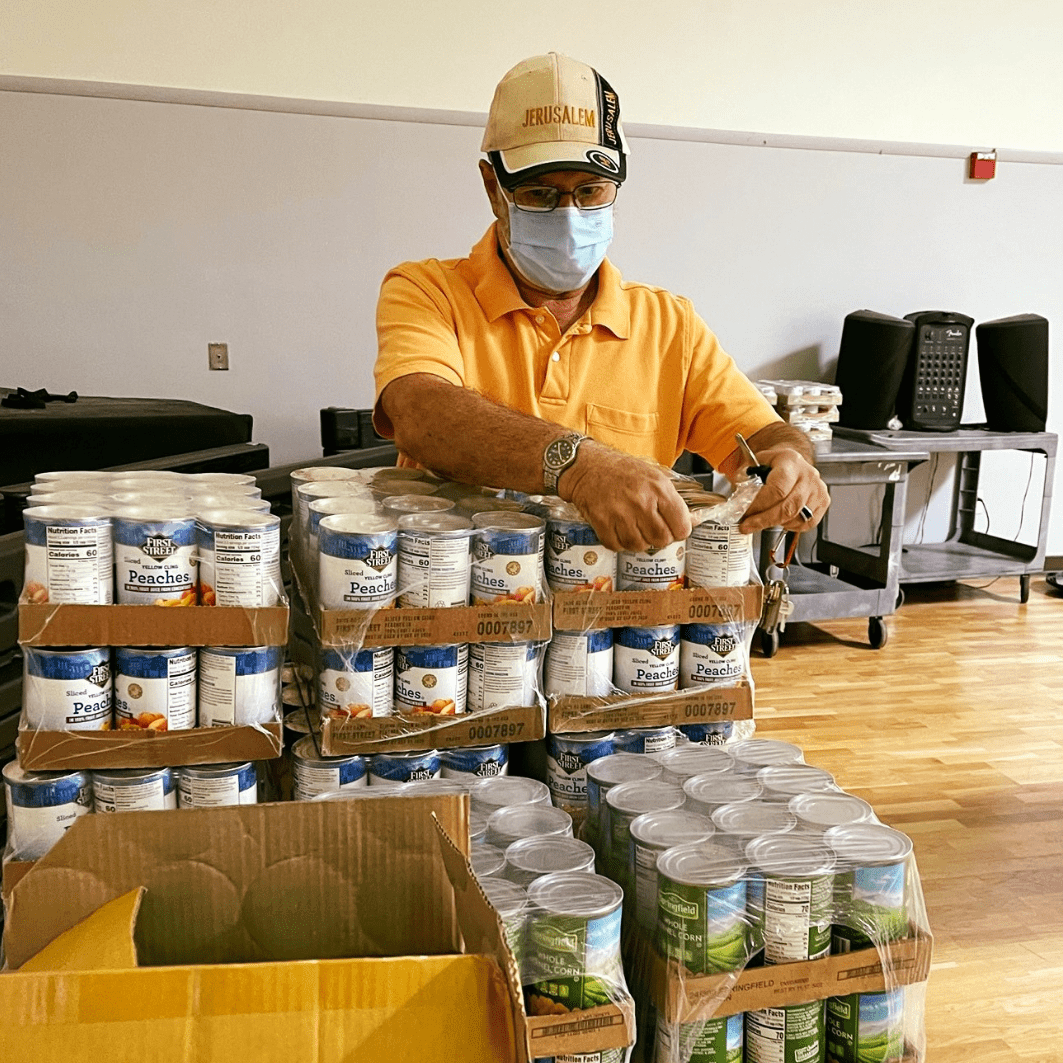

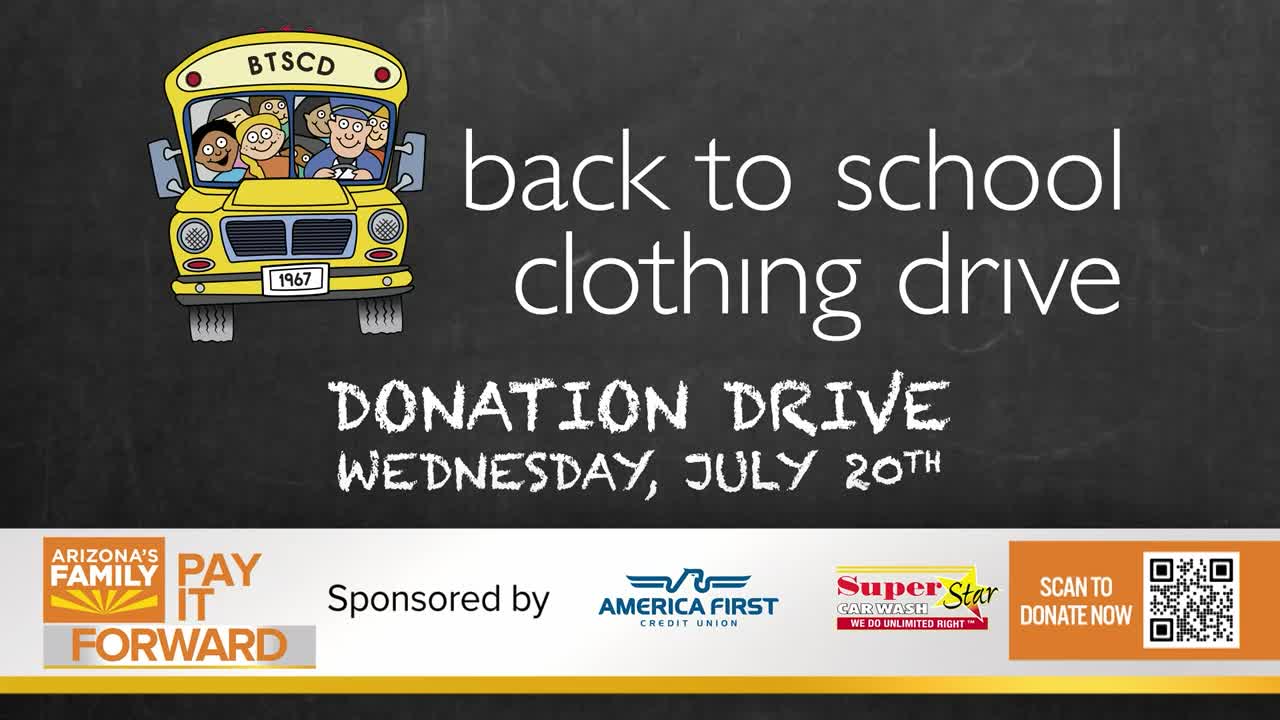

Help Phoenix Area Kids Prepare For A New School Year With The Back To School Clothing Drive

Tax Credit Central Arizona Shelter Services

List Of 6 Arizona Tax Credits Christian Family Care

Az Charitable Tax Credit Clubriver

Art Museum Phoenix Az Phoenix Art Art Gallery Art Exhibition

Az Tax Credit Donation The Pusd Education Foundation

Tax Credit Central Arizona Shelter Services

Phoenix Paintings Phoenix Painting Phoenix Art Artist Art

List Of 6 Arizona Tax Credits Christian Family Care

Will You Partner With Us To Help Those In Need

Arizona Charitable Tax Credit Mission Of Mercy Arizona Program